A financial plan template is a document that states an individual’s current financial spending as well as the strategy to achieve their long-term financial goal in the future. This starts with evaluation of an individual’s current work place, family status and future financial budget expectations. This may be done either with the help of a financial planner or individually. The purpose of a financial plan is to help an individual with their money and how it can be benefitted from later in the future. There are multiple ways to invest money in projects so that it can be returned later with better profits. Financial plans are quite flexible, they may stretch over a period of long time, allowing any unforeseen change in an individual’s life, whether that may be an unexpected move, new job or addition of a family member. For this reason, financial plans are devised comprehensively to keep all aspects in mind so that there will be no mistake that may disturb or cause a downfall later in the future.

Basic Steps in Creating a Financial Plan:

Financial plans do not have a particular template that should be followed. There are certain basic steps that need to be followed for an accurate financial plan:

• Financial goal: The first and foremost step in creating an authorized financial goal is determining the individual’s financial goal that they have set for the future. One should start by reviewing the short and long term objectives in mind, then all the goals and objects should be seen as one so that any future possibility can be planned. If one is thinking of starting a family, a down payment for a house as well as preparation for a wedding and the addition of new family members should be planned collectively.

• Previous and current financial spending: The next step is to record and state all the previous investments, expenses or loans that were collected. One should state all the assets owned by an individual or any sort of property. After recording the precious spending, review the current financial situation and all the other financial expenses, whether that may be bills, current expenses or any liabilities spent before. Knowing the current financial situation can help with building a better future.

• Creating a plan: After defining the objective and goals and understanding your current situation, work can be done on creating a plan that fits your schedule and renders a better future for your action plan. This may include any loan which one can borrow to meet his/her goals. Investments are a big help at this time and rental income can also help to better the situation.

• Implementation of Plan: Once the plan has been devised, it’s time to put this in action. One can only help himself/herself to build a better future by implementing the plan in one’s daily life. It is not necessary to take big and immediate steps to make the plan work faster. The plan should be implemented in baby steps, which may be completed in a long period of time. Either way, it will help with the future.

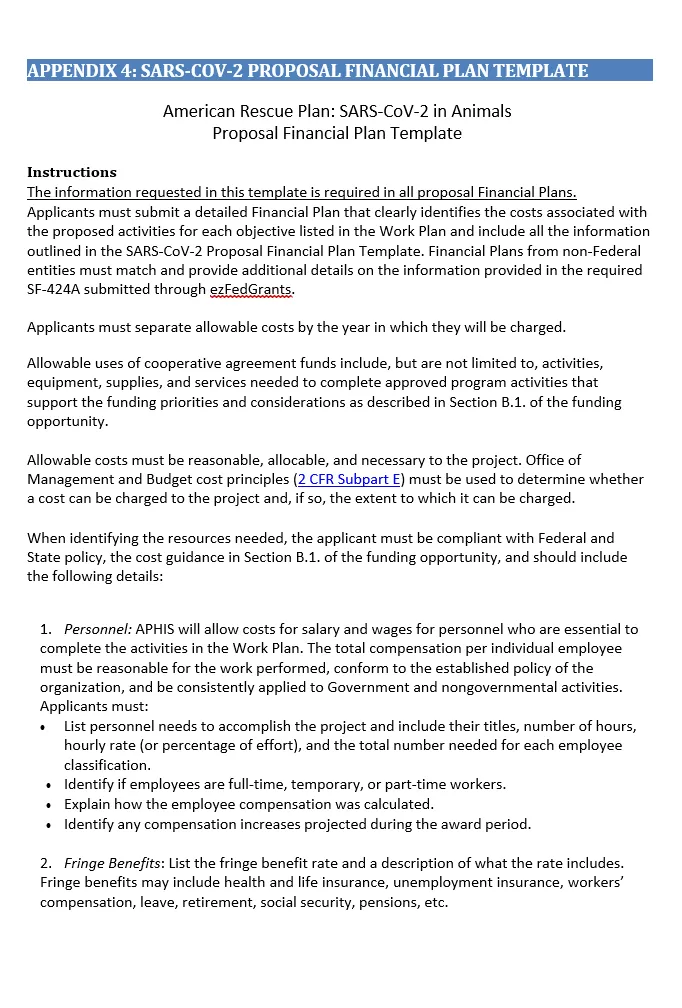

Template for Financial Plan

Web Source: www.aphis.usda.gov/animal_health/downloads/arp-financial-plan-instructions.pdf

Web Source: www.aphis.usda.gov/animal_health/downloads/arp-financial-plan-instructions.pdf