A credit reminder template, which is also called payment reminder, is a notification which is sent to the customer through various communication tools like; E-mail, SMS, phone calls, or letter to remind your clients of the overdue payment. It reminds the customer that the agreement date for returning cash has exceeded its maximum limit, and now the cash should be returned without any further delay. If the customer returns the money within due date, then he/she will not receive this message; it only arrives to those customers who didn’t make it to return within due date due to any reason.

Purpose of Credit Reminder

The main purpose of credit reminder is to inform the customers regarding the due date which has already passed. It means, they fail to make payment within committed time and still they are unable to send the money. Perhaps, if there is any specific reason, due to which they failed to send payment on time, they can mention while writing reply of credit reminder. Moreover, they can start the money transferring process as soon as the problem is solved. Another vital reason for sending reminder notifications, is to encourage them to complete their business transaction without further delay. At this moment, you should need to be polite and give them a fair time to return the amount. This can be done by increasing the time limit for the customer to arrange a new time and send it on a new due date.

Steps to Follow Along With Credit Reminder:

There are certain steps which can be taken once a client is failed to clear the dues regardless of sending multiple reminders. However, this process required management to make tough decisions. Following are the most common steps which you can choose if your client failed to make payment on time;

1- Imposing Fine or Extra Charges:

You can assign your bank or agent to collect some extra charges or fine amount along with the overdue amount, when client is returning the amount. For that purpose, you need to inform your client through a credit reminder. This reminder must be signed by the client as a means of confirmation from him/her.

2- Assistance of Recovery Firms:

Management should need to think before going to opt this option of getting assistance of recovery firms. Because this can make the customer indulge into many different types of problems. These firms are very professionals and know how to handle situations like this. So in order to stay safe from such firms, your client needs to make prompt payment.

3- Legal Assistance:

Another option which you can choose to get assistance of legal course. You have proof of transactions, where your client has given you written undertaking of making payment within due date. You can take these undertakings to a court of law and ask them to take necessary action against the defaulter. In this process, all your charges which you incurred to initiate the legal procedure, will be paid by the defaulter.

Credit Reminder and its Advantages:

One of the most important benefits of a credit reminder is it reminds the customer about the passage of the due date of returning credit as mentioned in the agreement. This creates a sense of responsibility for the customer that he/she should return the credit payment within due date, if due to any reason the customer couldn’t done it, then now the time arrives of submission without any further delay in it. It saves time as the sender doesn’t need to go to the customer and inform them, but it can be sent through Email, SMS, letter and many other online methods.

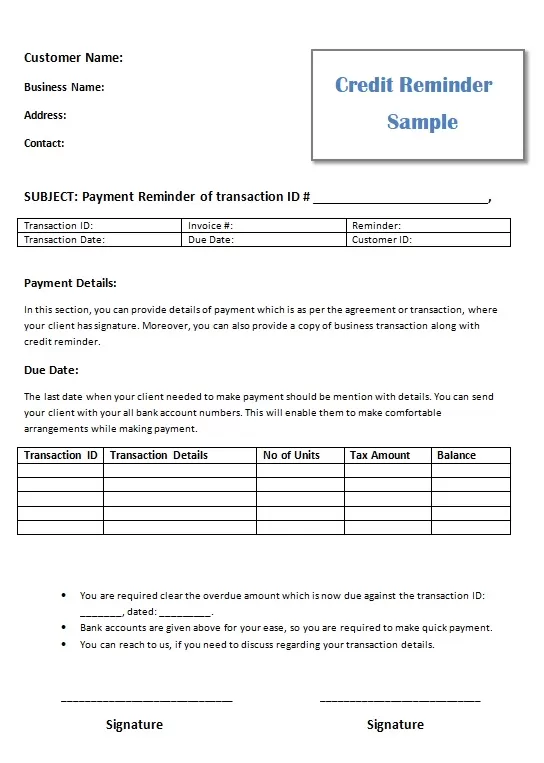

Template for Credit Reminder