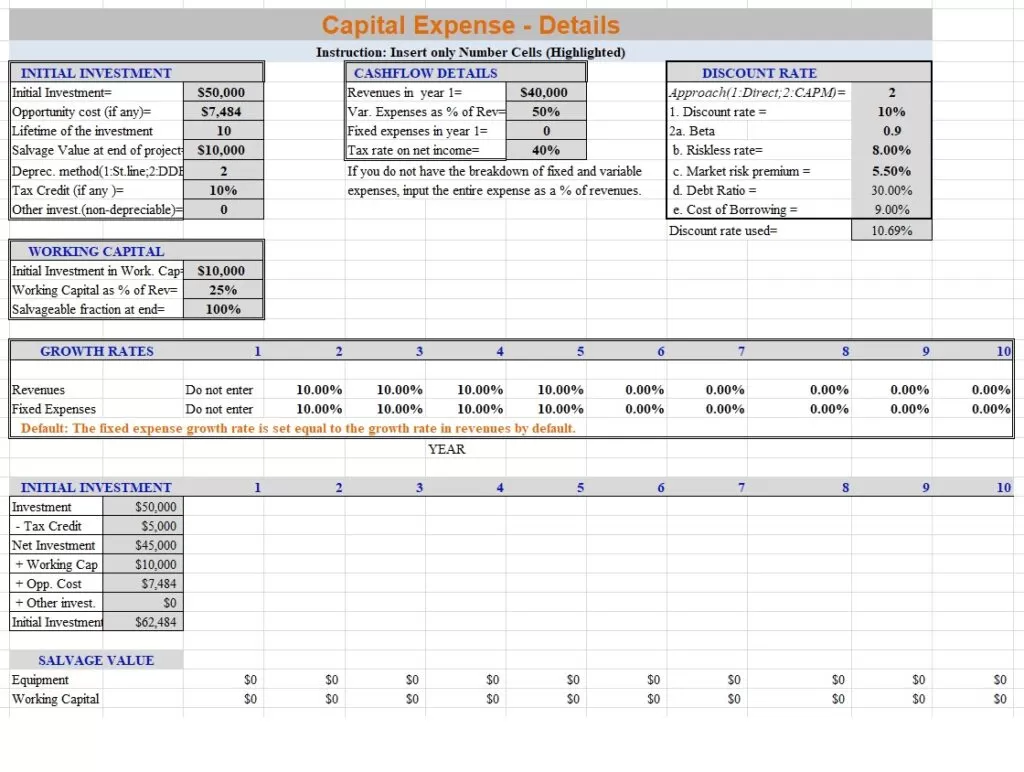

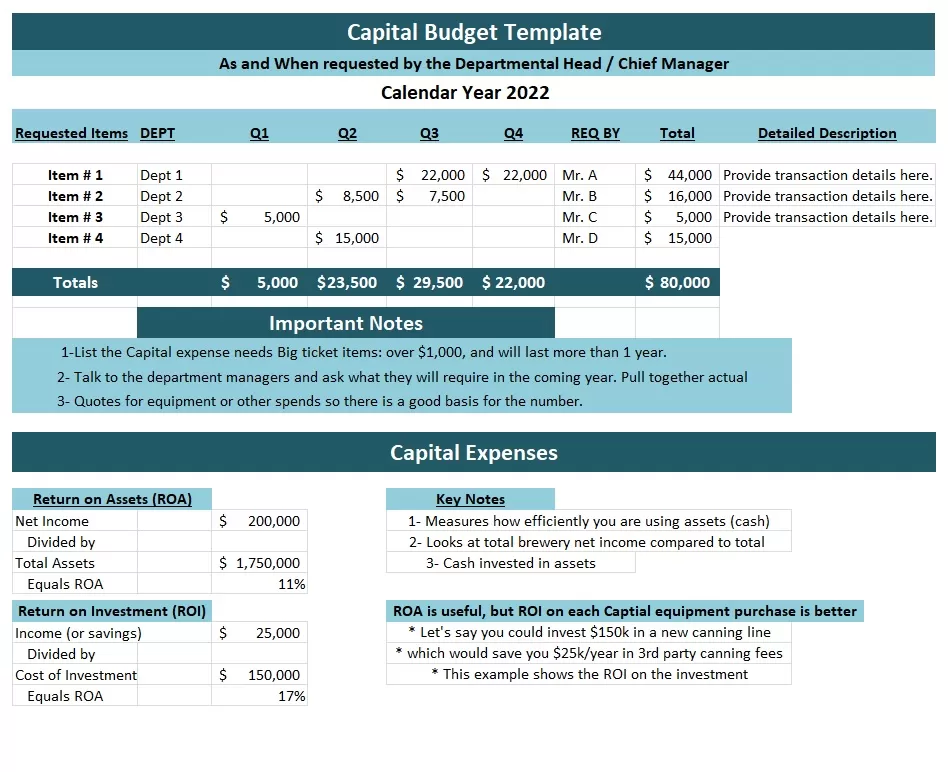

Capital expense template is used for those funds which used by an organization to upgrade, purchase or maintain a company’s assets to improve the productivity or efficiency of the company. The aim is that the assets should be used for fruitful purposes for at least one year or more. Examples of capital expenses are; money used for the building, office apparatus, computer gadgets, software or infrastructure and all these should have useful life span for more than a year. Capital expenses cover the spending on tangible items like machinery, furniture or fixtures, warehouses, vehicles, or intangible items such as legal documentation or license. All these payments or purchases are reported in the company’s cash flow sheet. These capital expenditures have solid effect on the finances of the organization in a short term as well as long term. It is important yet condemnatory stage for financial or company managers to take wise decision as it has great impact on the financial health of the company. Most companies keep a record of their previous capital expenses to show their investors that the managers are constantly putting money into business for growth and success.

Importance of Capital Expenses

The amount of money required to spend in a capital expense is an essential decision for an organization to make for following reasons:

1- In an initial stage of an asset of an organization, capital expense always increases, but eventually depreciation starts once the asset is being used in service. There will be a decline in the value of an asset throughout their functional lives.

2- The result of capital expenditure decision normally shows in the future. So, the capital expense plays an important role to drive the organization to its successful direction.

3- Most of the capitals tools are designed to meet organizations specific needs. It is very hard to reverse the decision with the company facing losses. The market is considered to be very poor for used capital equipment.

4- Capital expenditures are usually high or expensive for organizations like oil production, manufacturing or telecom. Whereas the investment expenses are used to purchase properties, buildings and tools. These expenses provide potential benefits to the company in a long run, but on the other hand, they require a large amount of money at once.

Challenges of Capital Expense

An organization’s capital expenses can easily get out of control if mismanaged or misdirected. The decisions made out of capital expenses can cost the company a lot of monetary losses. That’s why good management, planning and right tools are extremely important to overcome these kinds of situations. Following are the challenges which can be observed while recording capital expenses;

1- The process of measuring and estimating costs linked to capital expenses is too complicated and time-consuming..

2- Companies are investing too much on their capital assets to bring about great outcome from them. Whereas, it is not easy as it sounds, these potential outcomes come with great uncertainty or losses. Mistakes can be made even by the organization’s best forecaster. So, it is necessary to consider risk management when making financial decisions or planning. Even though all losses or risks cannot be possibly predicted.

Templates