A certificate of exemption template is a document that provides an agreement not to pay for something. It is a certificate that enables things free of tax which have tax on their purchases. Moreover, a buyer can use an exemption certificate under some particular conditions. If a buyer aspires to put up its property and hopes to use the property for an aim, it is exempted from sales tax. Basically, a certificate of exemption is an official document that is issued by the local government or assessment manager under the planning act. The federal government is an exempt organization. This certificate holds some important information, like the date of issuance of the certificate of exemption, name of the buyer and address, name of the seller and address, an identification number of business registration, signature of the buyer and the authorized person and some other important information by the requirement of a certificate of exemption.

Importance of Certificate of Exemption:

The exemption certificate template is very important because it provides different commodities free from taxes. It made the commodities easy for buyers because, mostly, it excludes all the sales tax from the purchases. Without this certificate, the seller will deduct advance tax or tax at source before delivery of certain goods or commodities. Moreover, a certificate of exemption confirms certain items, commodities and items can avail tax relief. It is very helpful in purchasing items because it provides tax-free items. The main purpose of getting the certificate of exemption is that it makes purchases easy because it provides relief of tax on different items. Moving further, the exemption certificate is often referred to as a blanket certificate. Basically, the advantage of using the blanket certificate is that there is no need for separate certificates of exemption on similar types of purchases.

Why use a Certificate of Exemption?

A certificate of exemption has many advantages because it helps customers to purchase things, commodities and products without any sales tax. It works only if the customers have a sustainable certificate of exemption. It lessens the non-taxed audit liability and makes things uncomplicated. It is very helpful for both customers and the sellers because it reduces billing mistakes because the data of registered exempted customers is presented online on tax decision software. It automatically exempted the tax from the things. It enhances the efficiency and productivity because of the relatedness of the three systems.

Disadvantages of using a Certificate of Exemption:

A certificate of exemption has many disadvantages because obtaining a certificate of exemption is a very costly process. It takes a lot of time, hard work, effort and, most importantly, money. It is a very lengthy process because it requires all the records of organization in due time. It takes all of your attention to fulfill its requirements. Another big challenge is that the public can easily examine the exempted organization because its business economics are open to the public. A certificate of exemption is not valid on all commodities, products and items.

Templates for Certificate of Exemption:

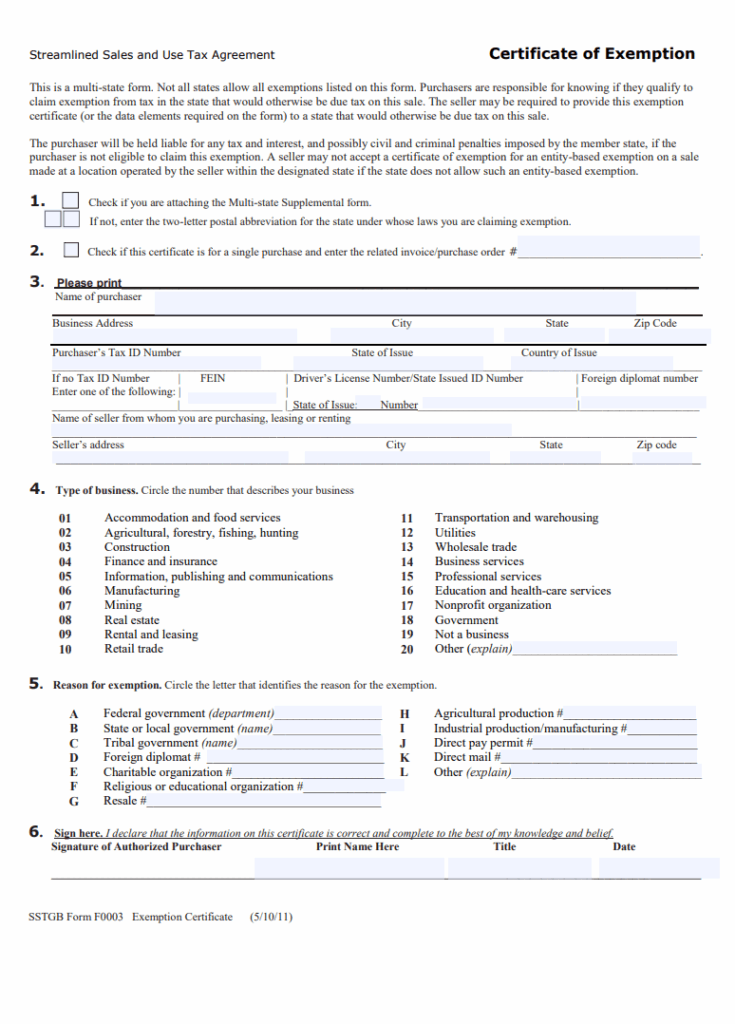

www.sai.ok.gov

www.sai.ok.gov

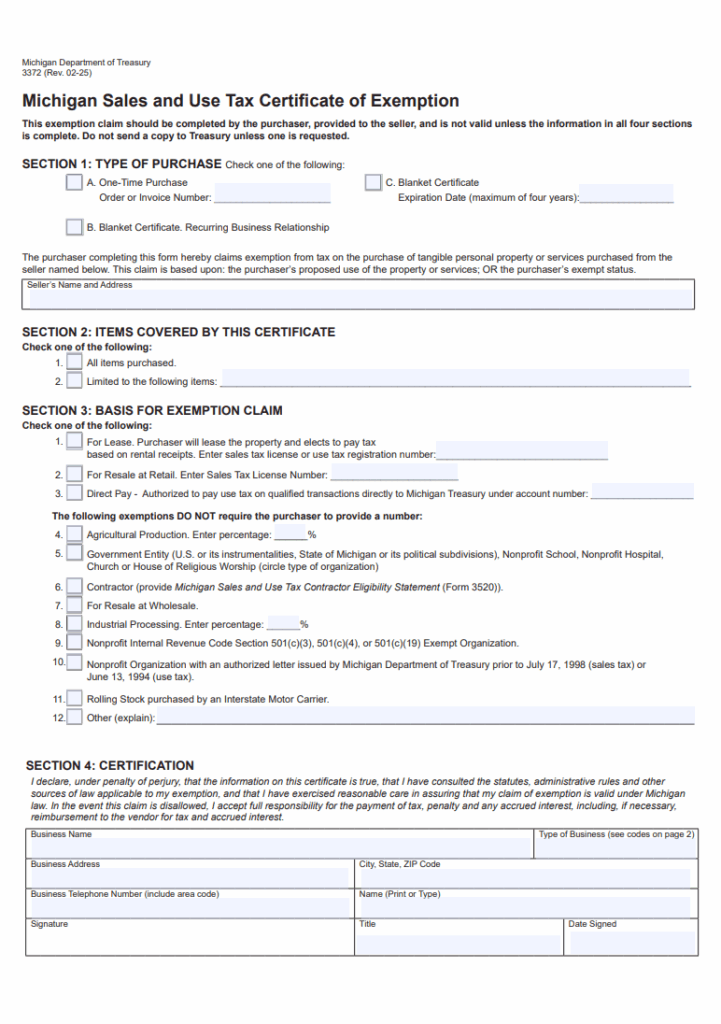

www.michigan.gov

www.michigan.gov

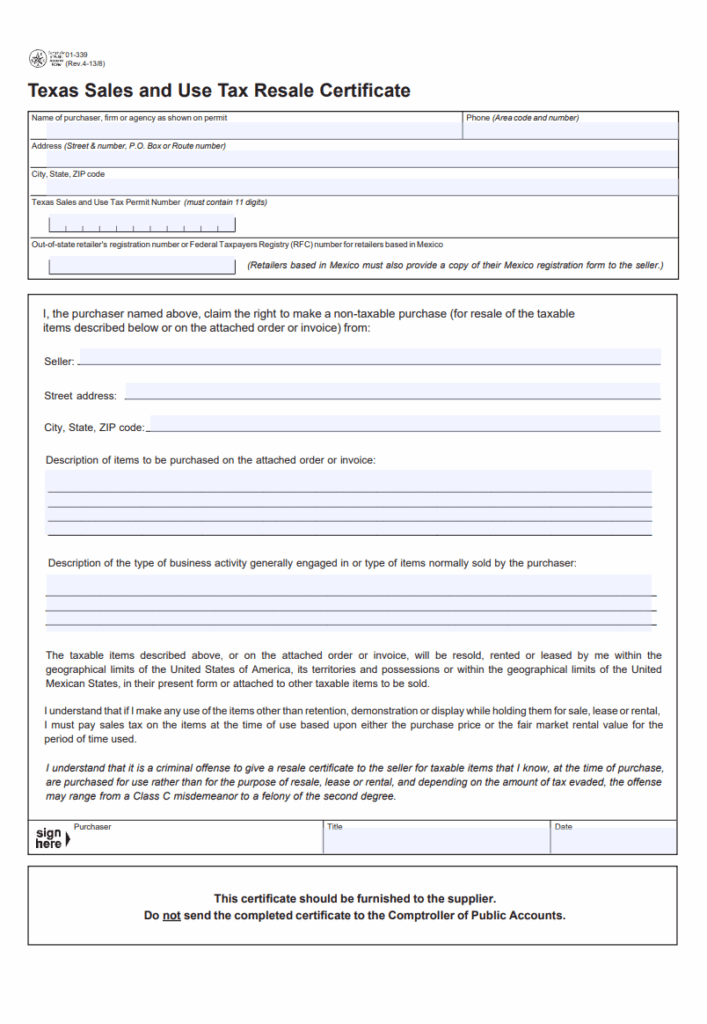

www.comptroller.texas.gov

www.comptroller.texas.gov