A loan agreement template is a legal document between two parties in which one of the parties gives a loan of a specific amount to the other party and the receiving party agrees to repay them the exact amount with interest on a specific date. It includes all the terms and conditions that are required by the contractor or the lender in order to lend the money to the other party. Moreover, this agreement cannot be further processed unless the borrower agrees to all the terms and conditions stated in the agreement form. Once the loan agreement has been signed, there is no more space left to make any changes to the conditions. However, under certain circumstances, the borrower can request the lender to postpone the date of repaying the loan.

What to Includes in a Loan Agreement?

A loan agreement includes all the terms and conditions that the borrower needs to be aware of before accepting the loan from the lender. These terms include the date on which the loan is being taken, the date on which the borrower agrees to repay the loan and other statements. Some of the general things to include in a loan agreement are as follows:

1. The date on which the agreement is taking place or the date on which the lender is giving the loan and how the loan is being given to the borrower (check or cash).

2. The name and contact information of the lender as well as the borrower.

3. The exact amount of money being lent to the borrower and the reason for which the amount is being borrowed. The reason is usually written by the borrower.

4. The date on which the borrower will repay the lent money and how they will repay it (in check or cash) and the inclusion of the amount of interest required on the payment.

5. The consequences of late payment and the extra interest to be paid on that.

6. The signature of the lender as well as the borrower.

Generally, in most dealings there are two copies of the agreement document. One of them stays with the lender and the other one with the borrower. In case of treachery or felony, the lender can charge the borrower.

Benefits a Loan Agreement

• When a lender lends a certain amount of money as a loan to anyone, they want assurance that their money will find its way back to them. In order to avoid fraud, the lenders need legit proof in the form of a document with the borrower’s signature and contact information to prove that indeed this person took this amount of loan from me and promised to repay me on that date.

• Once the borrower has the loan agreement in their hand, they become aware of their responsibilities regarding the repayment of the loan. They acknowledge the fact that not repaying the promised amount back with its respective interest could cause them a big problem. They can be charged with theft.

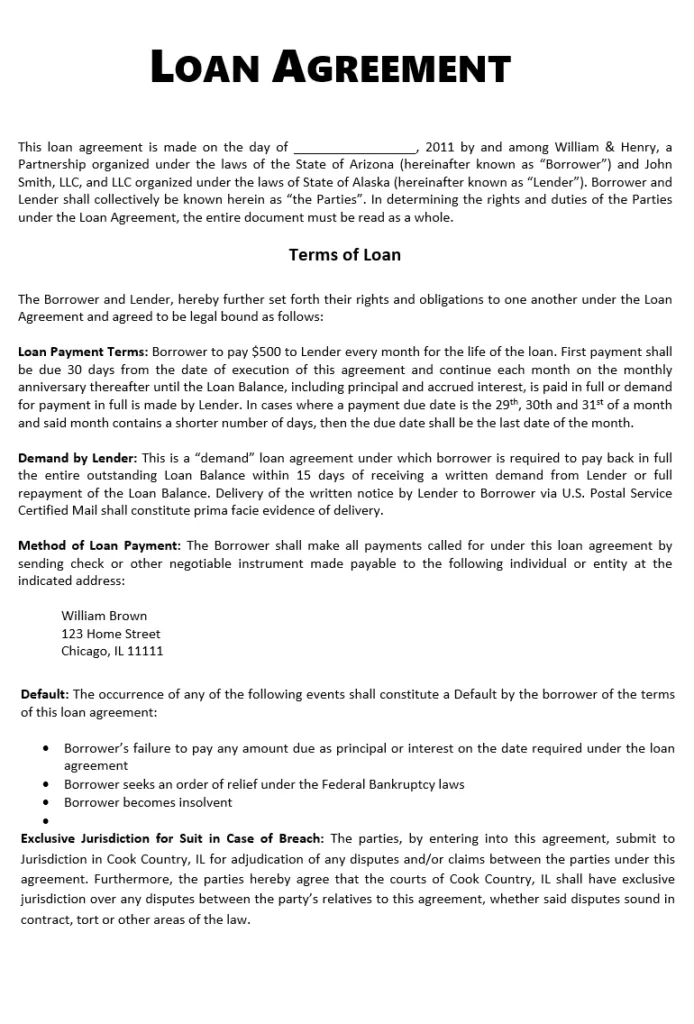

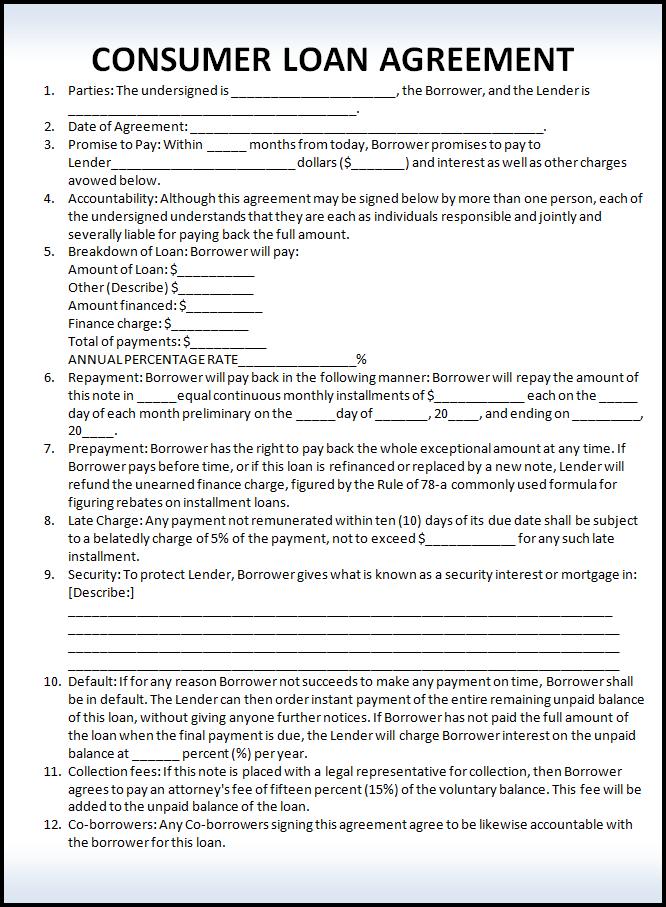

Templates for Loan Agreement

Source: www.socialenterprise.net

Source: www.socialenterprise.net

Source: www.wordstemplates.org/

Source: www.wordstemplates.org/